[EA REVIEW] Hobbit EA v7

Yes, I can hear you. "another martingale? are you kidding me?!"

Trust me, I'm not. The chances are you are more likely to succesfully learn to trade manually by yourself than to find a money making EA not using martingale or hedging. That's how hard it is to find a good EA worth to review.

Anyway, back to Hobbit. Its an EA using martingale, but with some settings you can use it to great effect of simple hedging and martingale. This review is about the V7 of the EA.

Entry Logic

I'm not able to find out how it places the entry as I don't have the source code. But based on my testing, it places martingale entries in one direction at each tick. i.e. Buy, buy and buy with multiplier until it hits the TP. What makes it more favourable is the placing of TP. At only 10pips, it hits TP quite fast and considerably reduces the risk that comes with multiple entries.

Hedging

Not much of an hedging to be honest. This is a setting shared with me by one of my friend. Instead of using one EA on one pair, I used two EA. i.e. EA1, EURUSD (buy); EA2, EURUSD (sell). This way, when the market is trending on one direction, one EA will be building multiplied entries while the other EA will be hitting TP consecutively.

For example on trending market.

Market@bearish trend.

i) EA (buy) , (E)ntry1, E2, E3, E(n)...until....TP@E1,E2,E3, E(n); at the same time

ii)EA (sell) , (E)ntry1, TP@E1. E2. TP@E2, E3, TP@E3, E(n), TP@E(n)

Image above to illustrate how the EA places its entries and books profit at both direction.

See how Buy EA(Yellow) builds layers of entries while Sell EA books profit after each entry.

Review

- Risk Multiplier - This is a custom field where you can enter any amount. As any other marti EA, this multiplies the next entry to cover losses of earlier entries.

- Money Management - Don't use this robot with less than 10,000 in equity (equivalent to USD100 in Cent account). The more the better. Martingale is about calculated risk in playing with probability until you eventually hit profit, therefore you need a lot in equity to use this technique. I used USD100 with 50% bonus = USD150/15,000 equity.

- TimeFrame (TF) - Frequency at which the EA places entry. While a safe TF is depending on your equity, TF M30 should be reasonable in my experience. This EA keep on opening entries every (n)TF set. Thus, if your capital is limited, frequent intervention is needed to adjust higher TF to save your account. When it opens more than 10layers/ entries or margin% is down to 10,000%, that's the time to increase your TF setting.

- Pair - My friend who gave me the EA recommended AudUsd, EurUsd and EurJpy. But the idea is any pair with low spread. It is crucial to have low spread as you can't afford to have candle reaching the TP but not quite hitting it because of spread gap. However, with other pairs ALWAYS test with demo first as I had cases of where the EA didn't place TP on some pairs.

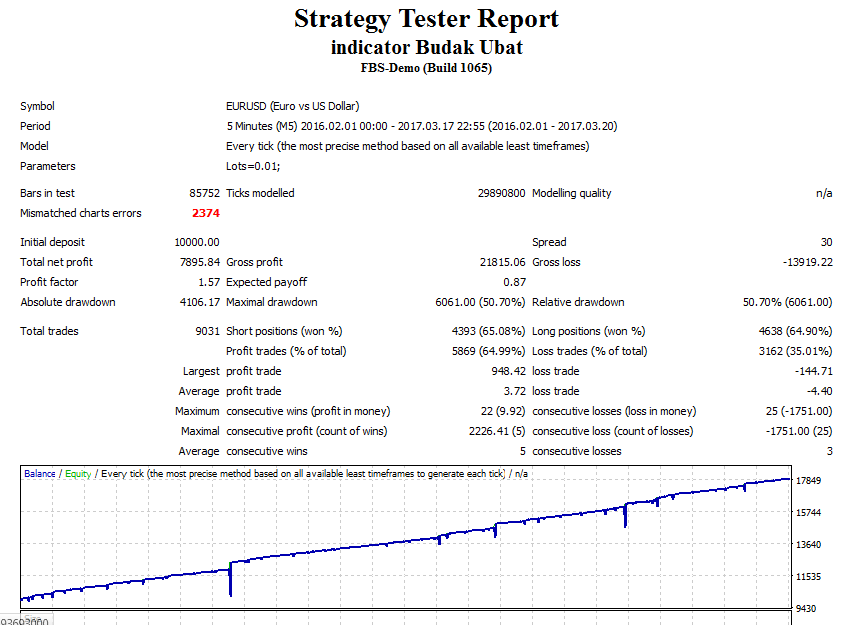

Backtest result

Will be updated soon.

Recommended Settings

- Use Cent/ micro account with atleast USD100 deposit. More is better.

- Use high leverage setting, > 1:500.

- Attach two EA in two charts for each pair. Set one EA to Long Only and the other to Short Only in Common tab.

- Multiplier : Default is 1,68; but 1.5 gives more peace of mind.

- Use 3pair only for abovementioned equity. e.g. EU, EJ, AU

- TF 30minutes. Lesser it is, more intervention needed.

- Lot size : 0.02 (Lesser is safer)

Verdict

Risk : ✸✸ Low to Medium risk. The risk is reasonably manageable but there were times during the trending market due to High Impact News, the EA can reach a dangerous drawdown level. Always keep it in check and increase TF accordingly.

Reward : $$$$ Medium to High return. This EA can fetch you profit on upward of 40% per month. Infact my friend reached 100% in just five weeks! That was quite a feat.

Reward : $$$$ Medium to High return. This EA can fetch you profit on upward of 40% per month. Infact my friend reached 100% in just five weeks! That was quite a feat.

introducing-brokers

ReplyDeleteintroduce new clients to a Forex brokerage, and in return the Introducing Brokers earn a generous, ongoing commission.

The forex market is driven byinterest-rates made by any of the eight global central banks. Interest rates are important to traders as the higher the rate, the more interest earned on currency invested and the bigger the profit.

ReplyDeleteGood post on the same time of his team to get a new opportunity.

ReplyDeletefree forex robot download